Expanding at a compound annual growth rate (CAGR) of almost 20%, the worldwide digital wallet market is expected to increase from nearly $57 billion by 2025 to about $119 billion in 2029.

This shows how the demand for a digital wallet like Payit app is increasing. In fact, people in UAE are more often than not managing money using these wallet applications. So, this shows that it is a great opportunity for businesses to make the most out of it.

If you are thinking about investing in digital wallet app development services, then we are here to help you with all the details. Read on and get all the clarity about how to get things done right.

PayIt Wallet App: An Overview

Powered by First Abu Dhabi Bank (FAB), Payit is the UAE’s first fully equipped digital wallet platform. This app streamlines the daily financial transactions and makes the entire process hassle-free.

All this can be done using mobile devices, and that too without needing a conventional bank account. Using the respective app one can pay utility bills, transfer money locally and internationally, recharge mobile phones, split expenses, and buy safely. Not only this, it helps one get amazing cashbacks as well after the transaction is done.

This shows how the respective application can be a great investment opportunity. It makes it easy for users in the UAE to manage their finances. So, to invest it right, below we discuss all about it in detail.

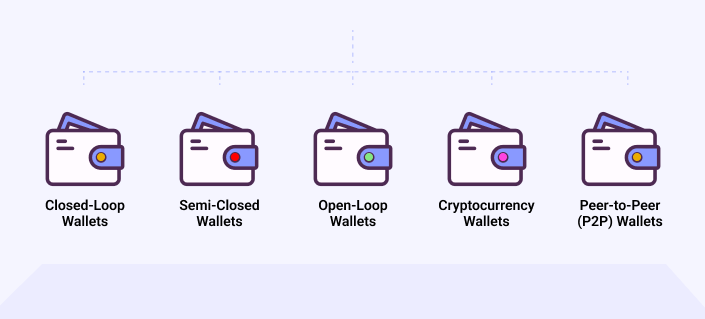

Types of Digital Wallet Applications

Digital wallets come in several forms, each suited to different business models and user needs:

- Closed-Loop Wallets: This type of application helps in completing transactions within a single merchant or brand.

- Semi-Closed Wallets: With the help of the respective application, you can make payments at selected merchants or partners.

- Open-Loop Wallets: It helps you have your banks or cards linked to make payments without any hassle from any part.

- Cryptocurrency Wallets: This app helps you in not only storing but using digital currencies for payment.

- Peer-to-Peer (P2P) Wallets: With this type of application, you can send and receive money instantly and securely.

So, it is important that you choose the right type of mobile application before planning ahead. It helps you achieve your business goals and get closer to your target audience.

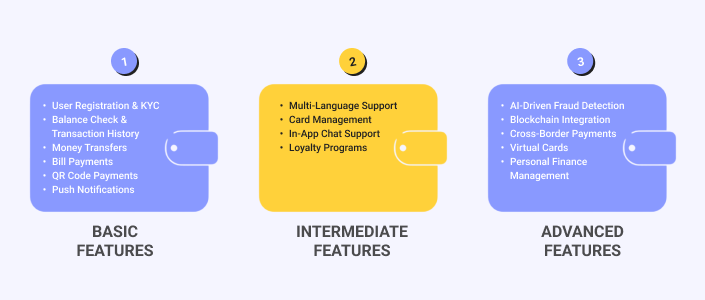

Key Features of a Digital Wallet App

One of the primary aspects of investing in a digital wallet app is having the right set of features. For this you need to understand the objectives and the budget you have in place. So, below we specify all the features that you can include in your platform.

Choose the right set of features that can help you match the user’s expectations and help you stand out in the competition.

Steps To Build Digital Wallet App Like Payit

Now you are in the primary section of the post where you get complete know-how of how to develop a digital wallet app.

1. Identify the Core Features & Purpose

Before starting development, clearly define what your digital wallet app will do and who it will serve. Decide if your app will focus on peer-to-peer transfers, bill payments, merchant payments, or a combination of these. Understanding your target audience’s needs helps prioritize features that will make your app valuable and competitive. For example, if your users are mostly expats, consider including international remittance options. A clear purpose ensures your app is focused and user-friendly, laying a strong foundation for the rest of the development process.

2. Conduct Thorough Market Research

Market research is crucial for building a successful digital wallet app. Analyze popular apps like Payit, ET Money, and YAP to see what features are in demand and where there are gaps you can fill. Study your competitors’ strengths and weaknesses, and pay attention to user reviews to understand pain points. Research also helps you stay updated on regulations, security standards, and user preferences in the UAE. By knowing the market landscape, you can design an app that stands out and meets real user needs, increasing your chances of success.

3. Choose the Right Technology Stack

Building a safe, scalable, high-performing digital wallet app depends on choosing the correct technological stack. Frameworks like Flutter and React Native are well-liked for Android app development since they let you create apps for both Android and iOS using a single codebase, hence conserving time and money. For the backend, dependable technologies like Node.js or Python can securely manage user data and transactions. Transaction records can be stored in databases, including PostgreSQL or MongoDB. Always make sure your stack is adaptable for future changes and supports robust security policies.

4. Design an Intuitive User Interface (UI)

Keeping people interested depends on a straightforward and appealing user interface. Emphasise simple navigation, clean designs, and fast access to key functionality such balance checks, transfers, and bill payments. Include assistance for both Arabic and English to serve the diverse population of the UAE. Ensure your app is responsive, runs well on all devices, and has accessibility options including dark mode and legible fonts. A well-designed UI not only increases user happiness but also fosters confidence and motivates repeated use of your digital wallet app.

5. Development of Application

At this stage, it’s time to hire a mobile app development company in Dubai or the UAE with experience in digital payment app development. Collaborate closely with your chosen team to finalize the app’s capabilities, design, and objectives. The development team will turn your ideas and designs into a working product, integrating essential features like payment gateways, KYC verification, and security measures. Choosing skilled digital wallet app developers ensures your app is robust, secure, and ready for the demands of the UAE market, resulting in a high-quality product.

6. Testing & Compliance Checks

A vital stage guaranteeing your program runs securely and smoothly is testing. Perform comprehensive functional testing to verify all features, load testing to evaluate app performance under high usage, and security testing to safeguard user data. UAE rules also call for compliance tests to satisfy Central Bank requirements, PCI DSS, and GDPR. This step helps identify and fix bugs, vulnerabilities, or compliance issues before launch, reducing the risk of costly problems later and ensuring a safe experience for users.

7. Launch and Maintenance

Your app is ready to launch on platforms including Google Play and the App Store once it passes all testing. Launching, though, is only the start. Attract users by promoting your app using social media, digital marketing, and collaborations. Fixing bugs, publishing updates, and adding new features depending on user input require regular maintenance. Engaging committed developers for continuous maintenance guarantees that your app is safe, competitive, and in line with evolving market trends, hence enabling you to keep users and expand your company.

Read Also: Top Android App Development Frameworks: Which One Suits Your Needs?

Cost to Build a Digital Wallet App Like Payit

After you have got the clarity on how the app similar to Payit is developed, let’s understand the process of costing as well. When it comes to the cost to build a digital wallet app like Payit, it depends on several factors. In fact, it will vary as per the below attributes.

- Features

- Complexity

- Development team’s location

- Delivery Time

These are the primary aspects taken for the calculation of the costs. In fact, the average expense can be around $50,000 to $80,000. But, if you are focusing more on advanced features, then it can increase by more than $100,000 or even more. All you need to do is to connect with the right company where you can have all the bases covered as per your needs. It will help you get the right end-product with effective management of e-wallet app development costs.

Technology Stack for Digital Wallet App Development

It is important that you choose the right technology stack to proceed with the development. Having the right tech stack is quite essential for performance, security, and scalability. Below are some of the essential tech stack for digital wallet app development:

- For cross-platform development—Android and iOS—choose Flutter or React Native.

- For managing business logic and transactions, use Node.js or Python.

- For safe and scalable data storage, use MongoDB or PostgreSQL.

- Data security using OAuth 2.0, biometric authentication, and PCI DSS compliance.

- Payment gateway, bank connection, and real-time transfers APIs.

- For consistent and scalable infrastructure, choose AWS, Google Cloud, or Azure.

So, when you are using the respective tech stack, it helps you have the app worth every penny. You will certainly get robust, secure, and ideal for future relevance. Now you might be thinking about how you can monetize your exquisite digital wallet app. We have it all for you below.

Monetization Strategies

Now you might be thinking about how to gain through the respective wallet app. To make things convincing, below are some steps that can help.

- For every transfer or payment processed using the app, charge a little fee.

- Include sophisticated tools or analysis with a premium membership.

- Process payments or market merchant deals to earn commissions.

- Showcase within the app relevant advertisements or offers.

- Give financial partners anonymised spending data.

These are the essential steps for you to follow to make money from the digital wallet app. But to succeed, you need to first connect with the right company.

Why Hire App Developers or a Mobile App Development Company?

Now that you are clear about the steps and costing aspects of developing a digital wallet app, it is important to move ahead and connect with the right team. This is where you need more research and time. You must hire app developers who have the experience and skills to do the job in same domain.

You need to check with the portfolio and understand whether the developers have the expertise to assist you with digital payment app development or not. Lastly, make sure to check with the budget and proceed ahead. If you are getting the product without any compromise then you can always consider the respective mobile app development company.

LL Technolab is one such name where you will have all answers for your development needs. We ensure that you get the requirements through best practices and within your budget.

Wrapping Up

When it comes to developing a digital wallet app like Payit in the UAE, it requires a proper strategy and understanding of the digital payments market. You need to understand the required features and plan your tech stack to move ahead with clarity. Also, make sure to focus on a user-friendly design that can help you gain more attention. Following the above steps can make it easy for you to get a secure and scalable digital wallet application like Payit to serve your needs.

If you are looking for experts to help you with the digital wallet application development, connect with LL Technolab now. We ensure your app will thrive and sustain the competitive UAE market. Consult now!