Key Takeaways

- The fintech market in the UAE is projected to see a valuation of $3.56 billion by 2025, registering double-digit annual growth.

- Real success is based on a combination of compliance, cross-platform innovation, and customized solutions relevant to the Middle East.

- A project’s overall costs are equally affected by the app cost, technical stack, user experience, and regulations.

- To build trust and facilitate uptake in the region, it’s important to partner with local regulation and experienced app development partners.

- Creating long-term competitiveness depends on long-term compliance checks and support after the app is launched.

Introduction

The digital revolution persists in gathering speed throughout the Middle East, prompting organizations to re-examine how they engage with financial services. Moreover, especially in the UAE and Saudi Arabia, it continues to attract investment and fintech innovation.

Organizations now must begin to engineer financial platforms that are more secure, scalable, and user-friendly by adopting today’s modern enterprise app development practices and working with financial app development companies that have unique expertise.

The middle east’s fintech sector has witnessed incredible growth in recent years thanks to visionary government policies, high mobile penetration and a rapidly growing digitally native population.

Industry reports predict that the UAE’s fintech market will exceed $3.5 billion by 2025, whereas Saudi Arabia has announced plans that would support hundreds of fintechs by the end of the decade to support its goal of being a regional focal point for advancements in fintech.

In fact, over 90% of adults in GCC countries are active smartphone users, and online payments, e-wallet services, and peer-to-peer lending are experiencing double-digit annual growth.

This post discusses the strategic and compliance-related issues and technology considerations for developing custom fintech app solutions within the Middle Eastern marketplace.

Why Fintech App Development is Essential for Enterprises?

The Middle East holds a particularly fertile environment for enterprise fintech solutions backed by proactive regulation and widespread digital adoption. Enterprises see this as an opportunity, not only to grow, but also to remain competitive in a market that is undergoing broad structural changes.

- Government-Supported Accelerators

Fintech innovation initiatives such as DIFC FinTech Hive in Dubai and ADGM RegLab in Abu Dhabi have emerged as a vital component of fintech acceleration in the Middle East. These government-supported innovation hubs seek to support firms and startups to test new products in a regulated and controlled environment. They enable firms to have access to regulatory sandboxes, mentor networks, and investor introductions to speed the product development cycle while ensuring proper accreditation. The outcomes are expedited prototyping, lowered barriers to market entry, and increased efficiencies in scaling new fintech products into disparate GCC markets.

- Creating New Revenue Streams

For firms, fintech innovation is about advancing beyond modernization and sharing new business possibilities. The formal introduction of custom fintech app solutions allows firms to diversify revenue generation, increase seamless digital transaction opportunities, and appeal to investor confidence by demonstrating regulatory compliance and advancing technical maturity. Fintech applications all ease the onboarding process, provide personalized services, and establish more data-driven decisions, all of which broaden audiences and add to existing profitability. With solidifying financial ecosystems in place, firms can capitalize on the momentum of rapidly growing market share to remain competitive digital leaders.

- Cross-Platform Development for Greater Reach

Cross-platform application development allows organizations to target customers on both iOS and Android at the same time, which is especially crucial in a region where devices are thoroughly mismatched and users have different preferences. Using technologies such as React Native or Flutter for development, organizations can ensure they have a cohesive design and lower development costs, while providing a single experience for users. The adoption of security measures and localized functionality, such as right-to-left text support, regional payment channels, and Arabic language options, provides greater trust and submission. The thoughtful combination of accessibility, thoughtful engagement, and performance will lay the groundwork for long-lasting usability and customer loyalty.

The Middle East Fintech Market: Key Trends and Data

The quick uptake of fintech solutions in the region is no coincidence. Its forward-thinking, policy making, significant investments, and a readiness to test new models create an environment where disruption is possible.

- It’s predicted that UAE fintech markets will reach $3.56 billion by 2025, and exceed $6.4 billion by the end of the decade. Growth potential will be driven by the flourishing digital economy and policies that support it.

- Middle Eastern countries have smartphone penetration above 90%, and the majority have multiple financial apps in use that support widespread adoption from both consumer and business perspectives.

- The fintech market in the Middle East and Africa was estimated at roughly $18.07 billion in 2024 and is forecasted to rise to an estimated size of $103.65 billion by 2033, also growing at a CAGR of approximately 21.42%.

- In 2024, approximately $265 million was raised by UAE fintech industry startups, representing approximately one third of total startup funding in the UAE.

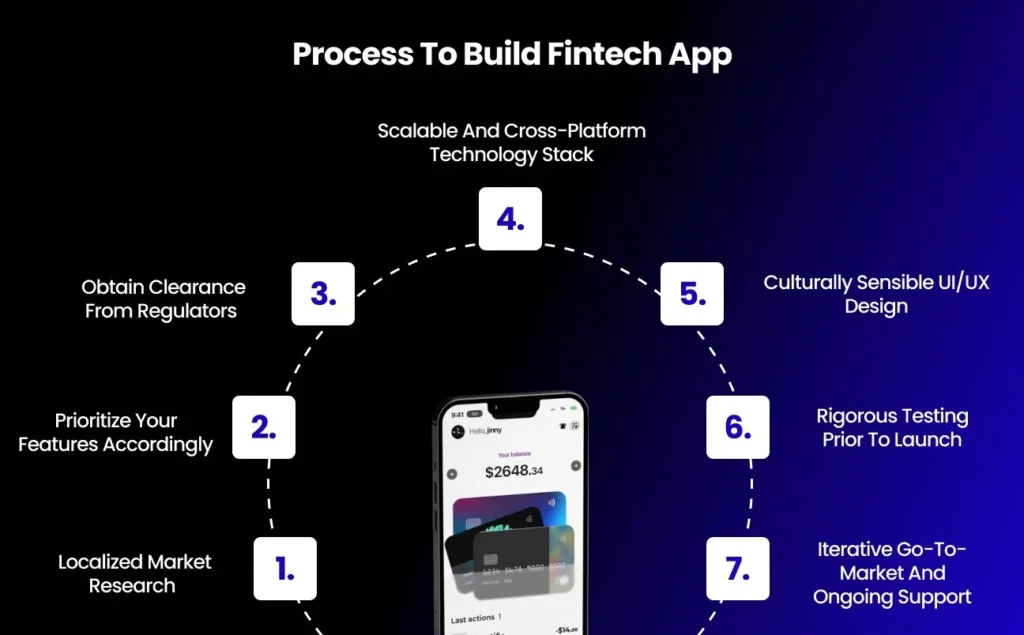

Steps of Enterprise Fintech App Development

Developing a contemporary fintech apps for the Middle East requires navigating significant opportunities combined with complex processes. Organizations must invest significant time into meaningful planning, appropriate technology strategies, and compliance from day one.

Step 1. Localized Market Research

Carry out thorough, localized market research to evaluate user behavior, differences in regulatory requirements in each region, and develop an understanding of any regional payment or banking trends. Doing this research prepares you to improve the fintech solution and account for real user needs while understanding the legal boundaries in their respective contexts. The depth of research is necessary for establishing a clear understanding of the features to build that will be acceptable and appropriate for their market.

Step 2. Prioritize Your Features Accordingly

Develop an understanding of what features to prioritize, for example, multi-currency capabilities, AI-supported budgeting, real-time transfers, or any compliance modules for regional differences. Thoughtful feature determination not only provides you with effective construction but also differentiates your application from your competition. Focusing on features that are relevant to the users will allow for user acceptance and regardless of their regional differences, particularly in the Gulf Cooperation Council.

Step 3. Obtain Clearance From Regulators

Speak to the major authorities such as ADGM, DIFC, Central Bank, and SAMA early in the design and development of the application to ensure you have the proper regulatory clearance and licensing obligations. Initiating this connectivity proactively assures that your apps adheres to regulations that are dynamic and frequently changing as they relate to fintech applications. Engaging local regulators also improves credibility with users.

Step 4. Scalable and Cross-Platform Technology Stack

Select a tech stack that is scalable and optimized for cross-platform deployment to reach users on both iOS and Android ecosystems while providing for future integrations. Modern stacks using Flutter or React Native facilitate rapid development and reduce maintenance overheads. Scalability allows your fintech app to expand as usage or features increase.

Step 5. Culturally Sensible UI/UX Design

Make a UI/UX that is culturally sensible, meaning supporting right-to-left text for Arabic, intuitive navigation, and color schemes that are appealing to the preferences of your region. Culturally responsive design creates trust and lends credibility, making the app feel more accessible to local users. Paying attention to culture enhances engagement and increases loyalty.

Step 6. Rigorous Testing Before Launch

Ensure security, performance, and compliance testing are performed to ensure reliability and compliance approval for your fintech app before launch. Security and load testing protect your users’ data, while compliance testing ensures adherence to regional laws. Rigorous testing reduces the chances of issues post-launch and reinforces users’ trust and confidence in your app.

Step 7. Iterative Go-To-Market and Ongoing Support

Launch your product in an iterative fashion and utilize relationships with local banks or neobank partnerships to ease launch and regulatory requirements. An incremental launch allows for fast feedback cycles, enabling rapid iterations to satisfy both regulators and customers. It will also be important to provide ongoing support to facilitate updates and scalability for ongoing success and compliance.

Also Read: A Guide To Develop Digital Wallet App like Payit in UAE

The Real Cost to Develop a Fintech App

The budget remains a key consideration for any company looking to develop a fintech app. The cost to develop a fintech app in this region is determined by a number of factors, including the size of the project, the regulatory burden, the technology you choose, and the level of customization.

- Basic transaction platforms can be priced around $50,000 to $80,000, while apps that are either more complicated or more advanced, with compliance and analytics, can cost $120,000–$210,000 or more.

- Enterprise grade builds with more advanced security measures, open banking integrations, and AI analytics start at around $200,000 and can move upwards from that price point.

- Additional costs will be incurred for more complex enhancements/features, added regional or regulatory customization, legacy technology integration, and stringent post-launch monitoring.

Having a custom mobile app development company with fiduciary knowledge of regional compliance is critical for delivering on time and on budget and driving sustainable growth.

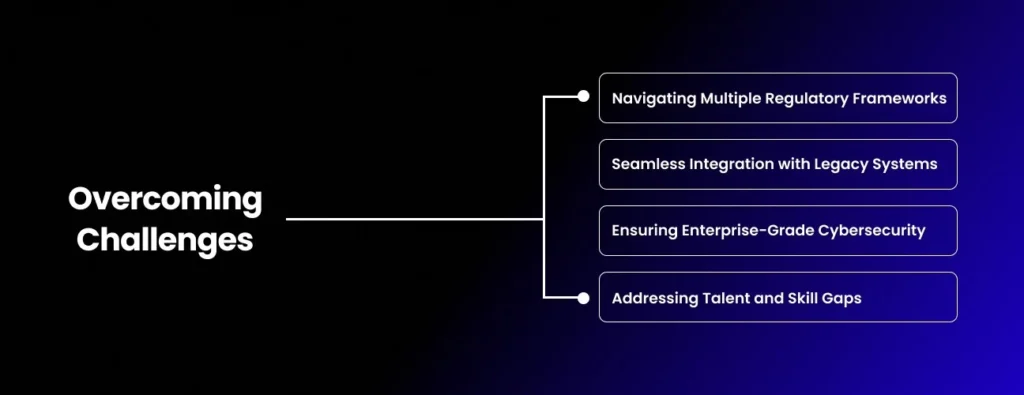

Overcoming Challenges: Middle East Fintech Realities

While there is potential, enterprises face a particular set of challenges, from working across multiple regulatory frameworks to implementing industry-leading security and integrating legacy systems seamlessly.

- Navigating Multiple Regulatory Frameworks

Each GCC country exhibits its own licensing processes and regulatory frameworks, which include AML (Anti-Money Laundering), KYC (Know Your Customer), and, sometimes, Sharia compliance considerations. This divergence in regulatory frameworks compels enterprises to access localized legal expertise and run pilots in regulator-led sandboxes.

Solution: Work with experienced legal counsel who are familiar with the appropriate regulations in each county, and use publicly-backed sandbox environments (e.g., DIFC FinTech Hive, ADGM RegLab) to ensure compliance is validated early on in your development process, to limit risks and ensure a smooth regulatory approval process.

- Seamless Integration with Legacy Systems

Many financial institutions do not necessarily employ or lend themselves to new fintech applications, having steadfastly operated on legacy systems that can be inflexible and unable to integrate with new applications. New modern features need to co-exist with these backend systems without substantially altering their real-time transaction processes.

Solution: Implement high-quality middleware with a robust API layer that acts as a bridge between legacy systems and new fintech applications. Middleware allows for instant payments, real-time analytics, and customer engagement tools that can leverage legacy backend systems without sacrificing performance and reliability.

- Ensuring Enterprise-Grade Cybersecurity

Financial platforms operating in the Middle East encounter intense cybersecurity hurdles, requiring the use of multi-factor authentication, continuous monitoring of security, and evidence of compliance with specific privacy regulations applied by local regulators.

Solution: Collaborate with software development companies specializing in enterprise financial applications, who can be trusted to build security into the design. Think of security, such as the sophisticated academics, threat detection, encryption and privacy protocols, and develop compliance audit frameworks to execute to ensure both security of the end user’s data and foster data trust.

- Addressing Talent and Skill Gaps

The regions have a limited supply of qualified professionals with deep experience with both fintech legislation and the latest available technologies. Finding and retaining talent who can operate within this divide can be difficult.

Solution: Work with fintech development partners who already possess regional regulatory knowledge, along with a sufficient understanding of current technologies like AI, blockchain, or cloud computing. Your partners can either supplement your teams or take a full ownership role in complex software development or regulatory compliance.

Technology Trends and the Case for Customization

The fintech environment is developing rapidly in the Middle East, making companies seek adaptable and technology-driven solutions to keep up with user expectations and regulatory changes. Below are important technology trends to consider when developing fintech apps, and the underlying motivators for customized solutions.

- Increase in Cross-Platform Applications

Cross-platform app development is the methodology of choice for financial institutions that want to provide a seamless and consistent experience across devices. By leveraging frameworks such as Flutter or React Native, organizations can streamline their app development to maximize efficiency, while ensuring a consistent user experience across both iOS and Android systems. It provides efficiency and allows companies to spend their resources in other areas, while also allowing organizations to get a product to market much faster.

- Custom Modular Fintech Applications

Custom modular fintech applications give organizations the flexibility that meets specific market and regulatory requirements while enabling them to leverage advanced capabilities such as open banking APIs, using blockchain technology and enhanced security. Off-the-shelf custom solutions increase flexibility for organizations to combine different services and tools, to connect with other legacy systems and ultimately provide a seamless integrated experience for users while complying with regulatory obligations.

- Cloud-Native and Scalable Architectures

Cloud-enabled and scalable architectures allow fintech applications to adapt quickly when it comes to new regulatory requirements and adding features for customers. This type of agility is crucial in fast-changing markets, like those in the Middle East, where compliance and customer demand can change rapidly. Additionally, cloud platforms yield improved security, reliability, and performance needed to make fintech applications enterprise-ready.

Selecting Financial App Development Companies: Best Practices

Selecting an appropriate app development partner is critical in setting the tone for quality, compliance, and time to market. Here are some points for enterprises to focus on during the selection process.

- Look for a history of Middle East fintech projects with experience in regulation, security and large-scale implementation.

- Verify the company has made a vibrant living of working collaboratively and building relationships with regulators, accelerators, and regional banks.

- Request agile, MVP-focused ways of work; rapid prototyping and iterative improvements are key to maintaining compliance and remaining competitive in the market.

- Require expanded support and continuity planning; ongoing 24/7 monitoring, rapid update capabilities, and thorough compliance checks are a great way to safeguard your investment.

Final Thoughts

There are unique opportunities in enterprise fintech in the Middle East, given an organization’s commitment to compliance, technology, and user experience. We have addressed regional growth, cost realities, technology options, and the role of specialized development partners in delivering scalable and sustainable custom fintech solutions. If you are still looking for a professional partner to help you with the same, then you can connect with the experts at LL Technolab and get all the assistance.

FAQs

1. What’s the average expense for fintech app development in the Middle East?

Answer: Development can vary anywhere from $80,000 to $300,000+, depending on features, compliance, integration and support requirements.

2. Who are the regulators of fintech app compliance in the UAE?

Answer: The implementation of compliance is governed by the Central Bank of the UAE, ADGM, DIFC, and the local free zones for all aspects of compliance including AML, KYC and customer privacy.

3. Why use cross-platform app development for financial apps?

Answer: To meet both Android and IOS markets at the same time without sacrificing features or branding and additional development expense.

4. How do custom fintech apps provide a greater level of compliance?

Answer: Custom apps can provide fine-grained adaptation to the legal, cultural, and technical requirements of the markets and institutions using the app.