Fintech app development has become a key part of financial services ecosystem innovation that evolves quickly towards digital-first approaches. As we witness the rise in the use of mobile devices, the need for safe, easy-to-use financial tools is also increasing higher and it has led to a lot of new investments and product releases.

The fintech sector is expected to be worth $608.35 billion in 2025 around the world. This shows how popular mobile-based solutions are in making an impact with both businesses and consumers. A financial mobile app development business nowadays needs to do more than keep up with new technology. It also needs to make sure that its apps are safe, legal, and easy to use.

Statistics show how big this change is. For instance, in 2024, there were more than 4.4 billion people around the world who used digital wallets. In industrialised economies, mobile banking now makes up more than 50% of all banking interactions.

So, if you are thinking about making an investment in a fintech mobile app development, then here we discuss all about it in detail to assist you in moving ahead with clarity. Read on.

Fintech Mobile App Development: All You Must Know

Fintech app development is the whole process of making mobile apps that turn financial services into digital ones, like digital wallets, budgeting tools, banking apps, and investing platforms. These programs have to deal with a lot of rules, users’ need for security, and their desire for a smooth experience.

Key Drivers of Fintech Growth

- Smartphones are everywhere: There are more than 7 billion active smartphone subscriptions around the world, making mobile platforms an important way to provide content.

- User-centred innovation: Features like biometric security, AI-powered insights, and quick payments are changing what users expect.

- Changes in regulations: Compliance standards around the world are changing, requiring development techniques that are quick and careful.

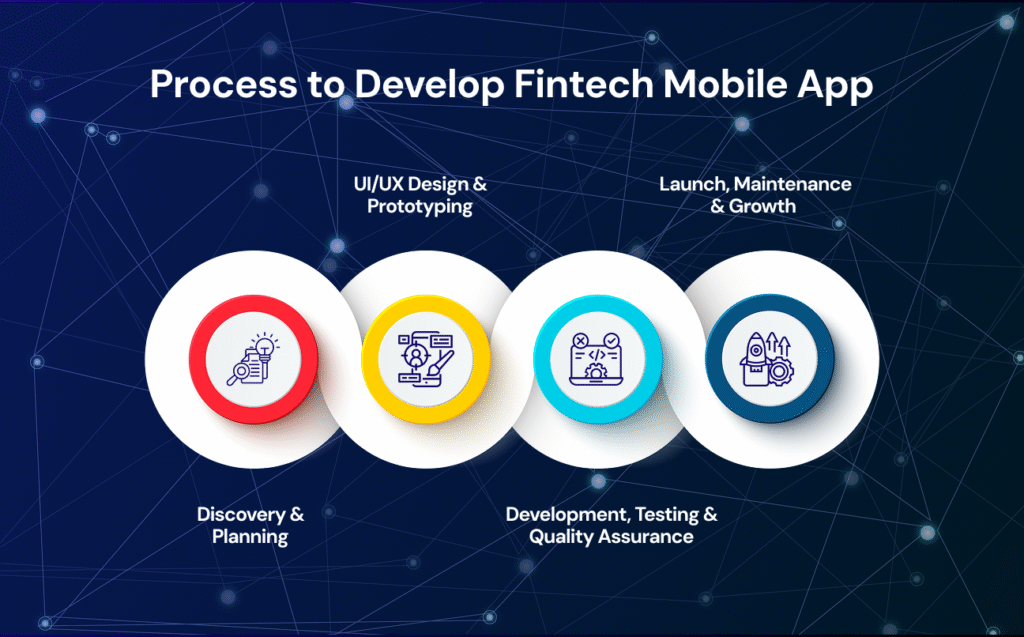

The Fintech Mobile App Development Process

To make strong fintech solutions, you need to follow a disciplined, multi-step procedure. We will look at each process and why it is important for making sure that apps are safe, high-quality, and follow the rules.

- Discovery & Planning

This first step includes doing market research, looking at the competition, making user personas, and figuring out what compliance requirements are. Good planning makes sure that everyone knows what features (such as KYC onboarding and secure payment flows) are needed and sets the stage for all the steps that follow.

- UI/UX Design & Prototyping

For a fintech app to work, people have to trust it and it has to be easy to use. The design team works on producing wireframes, prototypes, and style guides that make navigation easy and build trust. To make the experience better, it’s important to test it over and over again with real users.

- Development, Testing & Quality Assurance

Agile development teams here create modular, scalable systems with CI/CD pipelines, automatic coverage for unit and integration tests, and thorough security checks. Staging environments help find important defects before the software is released to the public, and red-teaming makes sure that the software meets industry standards.

- Launch, Maintenance & Growth

Analytics, feedback loops from users, and keeping an eye on regulations all help make a launch effective. Feature rollouts are frequently done in stages, and metrics like daily active users and conversion rates are tracked so that improvements can be made in the future. Regular maintenance makes sure that the system stays compliant and that users are happy.

Must-Have Features in Modern Fintech Apps

Advanced technologies and features that focus on security, usability, and flexibility are what make today’s financial products stand out.

- Biometrics and two-factor authentication are examples of multi-level security.

- Notifications right away and information about your account in real time.

- Dashboards for your finances and investments that are made just for you.

- Chatbots and AI help in the app.

- Integrations for KYC and AML that run on their own.

- Features of a digital wallet.

- APIs for smooth payment processing.

Digital Wallet App Development: The Heart of Modern Fintech

Digital wallet app development has become very popular. These apps help users safely store financial information, loyalty cards, and even crypto assets. The development approach is similar to the larger fintech roadmap, which focuses on security, scalability, and ease of use. Important steps are:

- Discovery: Finding out what target users need and what makes your product stand out.

- Design: Putting a smooth user experience first so that sending, receiving, and keeping money is easy.

- Development: making sure that the app works on all platforms, works with global payment gateways, and stays in sync in real time.

- Testing and Compliance: Doing thorough checks on security and user experience.

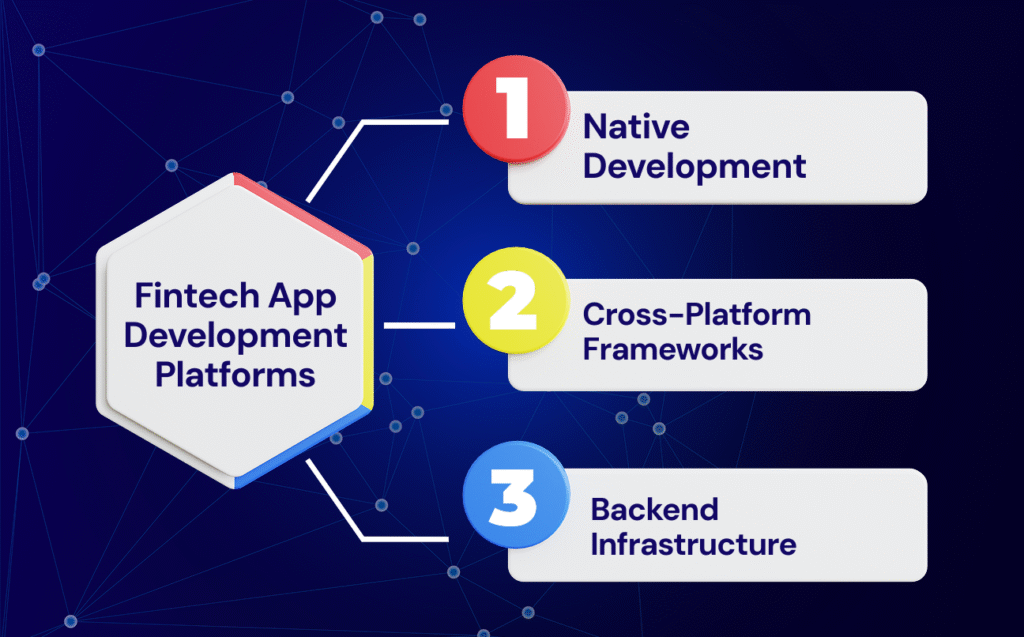

Mobile App Development Platforms for Fintech

To make financial apps that can grow, are safe, and work well, you need to choose the correct platforms for mobile app development.

- Native Development: iOS (Swift) and Android (Kotlin) are two examples of platforms that offer deep OS-level security but need separate codebases.

- Cross-Platform Frameworks: Technologies like Flutter, React Native, and Xamarin make it easier to exchange code between Android and iOS, which speeds up the time it takes to get to market.

- Backend Infrastructure: Cloud platforms like AWS, Azure, and Google Cloud, together with specialised finance platforms, help with scaling, performance, and following financial rules.

You should look at each choice based on what the project needs, what the rules say, and how much money you have.

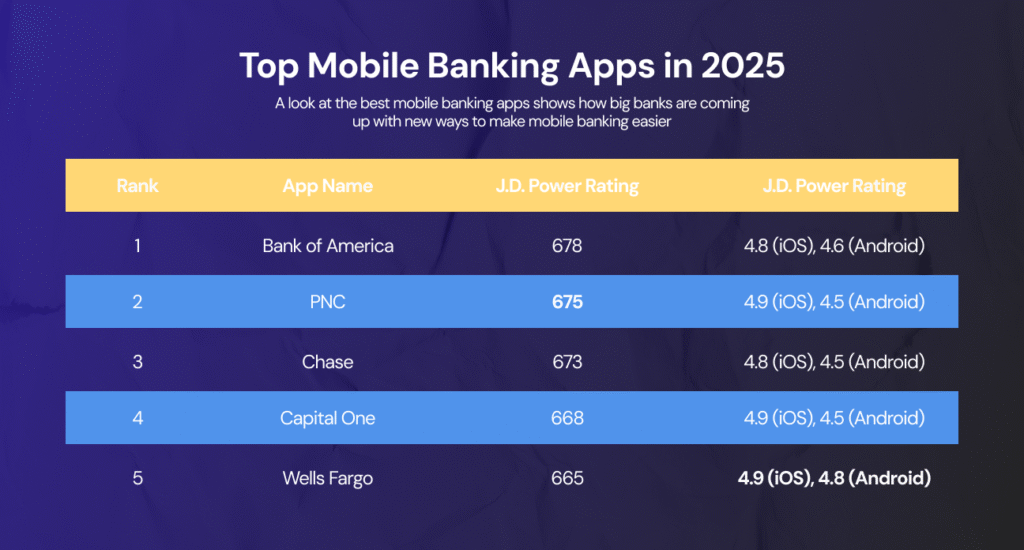

Top Mobile Banking Apps

Real-time balance updates, multi-factor authentication, virtual assistants (like Bank of America’s Erica), and strong payment and funds transfer options are some of the things that set these best mobile banking applications apart.

Trends in Fintech Mobile App Development (2025 and Beyond)

Several trends are coming together to define the future of financial app innovation:

- AI and machine learning: It can help you get more personalised insights, find fraud faster, and get better support.

- Blockchain Technologies: Making payments, loans, and investments more open and lowering the expenses of doing business.

- Contactless and QR payments: It makes it easier to design digital wallet apps.

- Biometric security: It is using facial recognition and fingerprints to unlock things.

- Composable Banking: Open APIs and modular platforms speed up the development and integration of new apps.

To keep up with these developments, you need to work with a fintech app development company that is ahead of the curve and has access to high-quality custom software development services.

How Custom Software Development Services Empower Fintech?

Some industries may be able to get by with generic solutions, but finance needs custom software development services because of its unique needs for compliance, speed, and security. Businesses can use these services to:

- Create solutions that fit perfectly with the way your organisation works, its risk rules, and the people who use it.

- Add advanced security protocols and audit trails that are tailored to meet regulatory criteria.

- Make it easy for new fintech solutions to link to old back-office systems without any problems.

- Keep making changes and improvements with little danger of downtime.

Using custom programming also makes sure that your app stands out in a congested market, which is a must-have for any financial firm.

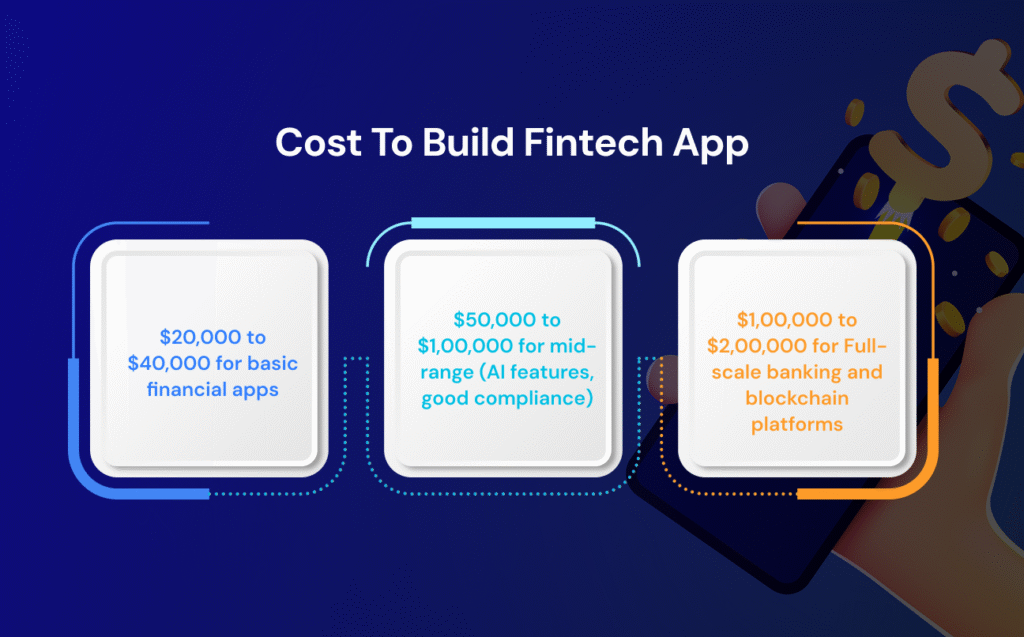

Cost to Develop a Fintech App

Being open about how much it cost to develop a fintech app is important for making budgets and figuring out return on investment (ROI).

Recent estimates for 2025 show:

Key cost drivers include:

- How complicated the app is and what features it has (such deep analytics and wallet integrations).

- Requirements for compliance with regulations and geography.

- Quality of the design and development team and where they are located.

- Connecting to outside services like payment processors, KYC systems, or trading platforms.

When you work with an experienced fintech app development services provider, they can help you avoid going over budget by effectively planning, budgeting, and carrying out complicated fintech projects.

Choosing a Fintech App Development Company

When you work with an experienced fintech app development business, they can help you avoid going over budget by effectively planning, budgeting, and carrying out complicated fintech projects.

- Proven expertise making finance apps that are safe, scalable, and follow the rules.

- A lot of knowledge in a specific area, including digital wallets, banking, investing, and insurance.

- Full-service fintech app development, from coming up with ideas to launching the app and keeping it up to date once it launches.

- The ability to quickly adapt the newest mobile app development platforms and rules.

- A promise to keep helping and coming up with new ideas.

Why Invest in Fintech Mobile App Development?

Investing in the creation of fintech mobile apps now gives businesses a competitive edge by:

- Meet the needs of tech-savvy people who are growing.

- Automate tasks, lower costs of doing business, and quickly enter new markets.

- Use the newest technologies, including AI, blockchain, and secure digital wallets, to give customers great financial experiences.

- Make apps that are strong, easy to use, and safe to build trust and loyalty with customers.

So, this shows how fintech app development can make a difference. But it is important that you consult with a seasoned expert to move ahead efficiently. LL Technolab can help you with a complete digital transition through customized mobile app development services. Connect now and experience the ever-changing world of digital banking seamlessly.